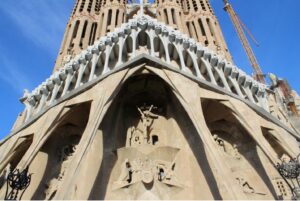

SEC Tells Advisers What Not to Do in Advertisements

SEC’s Division of Examinations (“EXAMS”) issued a risk alert on its Initial Observations Regarding Advisers Act Marketing Rule Compliance (the “Risk Alert”), giving compliance officers an unexpected gift by sharing examples of deficiencies, ranging from books and records violations to materially misleading advertisements. Compliance officers now have some very specific guidance on practices that get firms in trouble under the Advisers Act Rule 206(4)-1, the “Marketing Rule,” to discuss in training and when faced with overzealous marketing teams.

EXAMS noted that many advisers updated their policies and procedures to conform to the Marketing Rule, provided training for their staff, and established a review process for advertisements. The Staff noted, however, that some advisers failed to address some of the rule’s more detailed requirements, such as the requirements for testimonials, endorsements and third-party ratings. Simply put, the Risk Alert tells advisers to read the Marketing Rule carefully, ensure that their policies and procedures address the requirements thoroughly, and distribute marketing materials that meet the rule’s requirements and are not materially misleading.

Here are the top lessons from the Risk Alert:

- Compare your policies, procedures and practices to the requirements of the Marketing Rule and the accompanying books and records rule. EXAMS highlighted the following deficiencies:

- Failure to maintain copies of questionnaires or surveys used to prepare third-party ratings

- Failure to keep copies of social media posts

- Failure to maintain records to support performance claims in advertisements

- Update Form ADV Disclosures to reflect your advertising strategy. Some firms failed to disclose in Form ADV Part 1A that their advertisements included:

- Third-party ratings on their websites and social media posts

- Performance results

- Hypothetical performance

- Review Examples of Violations of the “General Prohibitions” and Update Your Advertising Disclosures Accordingly.

- Don’t state that your firm is “free of all conflicts.” Chances are good conflicts exist.

- Don’t inflate your staffing levels or qualifications. (For example, don’t include a statement that “a network of personnel performs advisory services” when only one person manages the account.)

- Be truthful about your advisory services and products. For example, don’t advertise an ESG mandate if your firm does not have one. Do not tell potential clients that you recommend investment strategies based on their appetite for risk when all clients are placed in the same strategy. Do not discuss a formal securities screening process if you are not using one.

- Tell the whole truth. EXAMS cited several examples of advisers including only part of the story in their advertisements. One example included using lower fees in calculations for a net of fees performance returns than the fees offered to the intended audience. Another example included advertisements where the adviser indicated they were “seen on” national media without disclosing that the appearance was a paid advertisement.

- Review Advertisements with Performance Data for Inaccurate or Incomplete Disclosures. EXAMS noted deficiencies in performance advertising, including:

- Comparing account performance to a benchmark index without defining the index or providing disclosure about why the index was being used

- Discussing investment products that are no longer available

- Showing performance information without sufficient context, “such as advertising performance during periods when most investors would have experienced the advertised performance returns because of general market performance.”

- Using third-party ratings without disclosing the methodology for the rating. For example, stating the firm is a top adviser without disclosing that the rating was based on assets under management and the number of clients, not quality of service.

- Touting testimonials on the firm website without disclosing that the clients purchased a third-party product the firm offers but were not firm clients.

- Don’t talk about Benefits without Discussing Risks. EXAMS noted that firms highlighted their performance on social media without also “disclosing the material risks and limitations associated with the potential benefits.” The staff found this violated the requirement that advertisements be fair and balanced.

- Don’t Exclude Unrealized Investments from Total Returns. EXAMS specifically called out advertisements “that included the performance of only realized investment information in the total return figure and excluded unrealized investments” as not being fair and balanced.

Advisers should review the Risk Alert carefully. EXAMS has provided many examples of what not to do, so firms should pay attention.

Photo by Mark Hayward on Unsplash

SEC3 provides links to other publicly available legal and compliance websites for your convenience. These links have been selected because we believe they provide valuable information and guidance. The information in this e-newsletter is for general guidance only. It does not constitute the provision of legal advice, tax advice, accounting services, or professional consulting of any kind.

Top Compliance Program Mistakes (and How to Avoid Them) (Part 3 of a three-part series)

By addressing the common pitfalls discussed in this article, firms can strengthen their compliance infrastructure and better demonstrate their commitment to regulatory responsibility.

Top Compliance Program Mistakes (and How to Avoid Them) (Part 2 of a three-part series)

Advisers often spend significant time drafting compliance manuals, but are these policies truly effective in daily operations and risk mitigation?

Top Compliance Program Mistakes (and How to Avoid Them) (Part 1 of a three-part series)

In this first post of our three-part series on common compliance program mistakes, we explore why many firms fall into the trap of the “neglected compliance manual” and how to transform it into a relevant, firm-specific, and engaging resource.

A New Era for Co-Investments?

The SEC just proposed major updates that could make life easier for BDCs, closed-end funds, and their advisers when it comes to co-investing.

Regulatory Roundup for February and March 2025

Stay informed with our February–March 2025 Regulatory Roundup, featuring practical insights on key SEC developments, including updates to the Marketing Rule, crypto regulation, and Rule 506(c) under Regulation D.

7 Ugly Truths About Compliance: a Primer for New Chief Compliance Officers

Being a Chief Compliance Officer is an important job but before you accept the offer, there a few things you should know. Enjoy!

For over two decades, we have been providing compliance consulting services and servicing as outsourced Chief Compliance Officers. Our professionals have served as SEC regulators and in senior leadership, guiding the industry’s principal compliance association. Our consultants also have hands-on industry experience as chief compliance officers, experienced securities attorneys and senior management of investment advisers, broker-dealers and fund administrators.

What can SEC3 do for you?

SEC3 offers an extensive suite of customizable compliance services for investment advisers, private fund advisers, CPOs, CTAs, investment companies, institutional investors and broker-dealers which can complement your internal compliance program on a one-time or recurring basis depending on your needs.

Call us today at (212) 706-4029 x 229, or shoot us an email at info@SEC3compliance.com so we can set up a time for one of our consultants to discuss your needs and how we can help.