A New Era for Co-Investments?

The SEC just proposed major updates that could make life easier for BDCs, closed-end funds, and their advisers when it comes to co-investing.

The SEC just proposed major updates that could make life easier for BDCs, closed-end funds, and their advisers when it comes to co-investing.

Stay informed with our February–March 2025 Regulatory Roundup, featuring practical insights on key SEC developments, including updates to the Marketing Rule, crypto regulation, and Rule 506(c) under Regulation D.

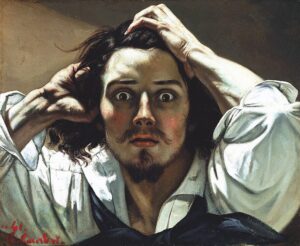

Being a Chief Compliance Officer is an important job but before you accept the offer, there a few things you should know. Enjoy!

Check out the latest trends we are seeing in SEC examinations for private fund managers, including a sharper focus on conflicts of interest, fee transparency, and compliance with evolving regulatory expectations.

SEC Compliance Consulting, Inc. (SEC3) is excited to announce that we have been recognized for thought leadership in the compliance space by JD Supra, as part of its 2025 Readers’ Choice Awards!

Check out our latest tips on updating your Form ADV.

Welcome to our January 2025 Regulatory Roundup, where we provide practical advice on the latest regulatory headlines.

As we look back on the SEC’s actions in 2024, we wanted to share our thoughts on lessons learned that we believe will carry through to 2025.

Stay informed with our December 2024 Regulatory Roundup, covering key SEC enforcement trends, leadership transitions, and crucial compliance lessons for investment advisers.

Discover the key updates your compliance program needs in 2025 to stay ahead of SEC scrutiny and protect your firm from costly missteps.

Dallas, Miami, New York, Philadelphia, Washington, D.C.